Mercy Corps AgriFin and Rabo Foundation are proud to release the outcome of a study carried out over several months, covering research and analysis into the demand-side, supply-side, and broader ecosystem of the digital agricultural space in Indonesia. As part of the study, we propose twelve potential interventions for development actors and funders engaging in digital services for agriculture in Indonesia.

Access a downloadable version of this blog, executive summary, and full-length landscape study.

Introduction

Over the past six years, Indonesia has made great strides towards increasing financial inclusion; this is especially true in rural areas where agriculture is the primary income source. Agricultural bank account ownership sits at 38% compared to professional and government workers, who average between 89-93%. Our landscape study with Rabo Foundation analyzed farmer profiles, available financial services, and digital solutions. We also looked at the ecosystem of digital financial services (DFS) in agriculture and impactful interventions by development actors/funders.

Current State of Play

We examined why farmers lack bank accounts in the first place. Most agricultural transactions are cash-based, including trade credit; thus, farmers do not need bank services. Additionally, many value chain actors find it difficult to coordinate across all stakeholders to convert to non-cash modes of payment. Finally, there is limited banking infrastructure in remote areas, and many farmers lack paperwork the necessary paperwork to open a bank account (i.e. national identification)

From an infrastructural perspective, banks also face challenges in delivering products and services to rural communities. Many products and services more attractive to rural communities require specific government licenses that most institutions do not have. Furthermore, our study found that Indonesian banks lack agricultural expertise and data, leaving them with little ability or incentive to serve smallholders.

Additionally, bank field agents would need to foster strong relationships with farmers, especially collectors. At the moment, credit guarantee schemes such as Kredit Usaha Rakyat (KUR) have mobilized credit in the agricultural sector to reach MSMEs and Co-operatives but banks struggle to meet their quotas.

In Indonesia, more than 60% of credit is accessed through semi-formal and informal sources even by those who have access to credit to formal sources like banks and non-bank entities (P2P/crowdfunding platforms, pawnshops, multi-finance). 9.9% of the people who have access to only informal credit are rural-based female farmers older than 54 years with low levels of education and from households with the lowest quintiles of the Producer Price Index (PPI) distribution. These statistics highlight the immense opportunities for private actors to provide competitive digital agricultural credit and related services to reach the underserved population.

Opportunities for Digital Services for Farmers

The structure of value chains affects smallholder farmers and the viability of implementing digital services. Plantation and premium export crop value chains can offer some quick gains while staple crops and general horticulture can unlock further impact if successful. Palm oil, a plantation crop, is a prime example of a tight value chain because it has a finite set of buyers, and farmers either work with buyers in schemes or via traders. In fact, large agribusinesses are required to have supply chain and data management platforms for certification, traceability, and farmer information tracking requirements. Therefore, it will be easier to extend digital financial services by partnering with estates for market entry. These farmers have secure cash flows and are more de-risked for financial service providers with stable livelihoods.

Maize, a staple crop, has large but loose value chains and contributes to food security for a fast-growing population. Currently, many end-to-end service providers operate across food crop value chains at once. Most start in food crops before expanding to others. However, the high cost of customer acquisition, volatile cash flows, and perceived higher credit risk lowers the viability of digital services. Nonetheless, there is a high impact potential for digital services as many sub-commercial farmers play a critical role in national food security.

Opportunities for AgTechs and Fintechs

Value chains are important drivers for the type of digital solutions offered to smallholder farmers. But many solutions among industry players are still in the nascent stage with less than 10,000 users. Supply chain, data, and end-to-end platforms have acquired more users than others. There is potential in business models that foster partnerships across key players that focus on different sets of services, and examples exist where this is done well.

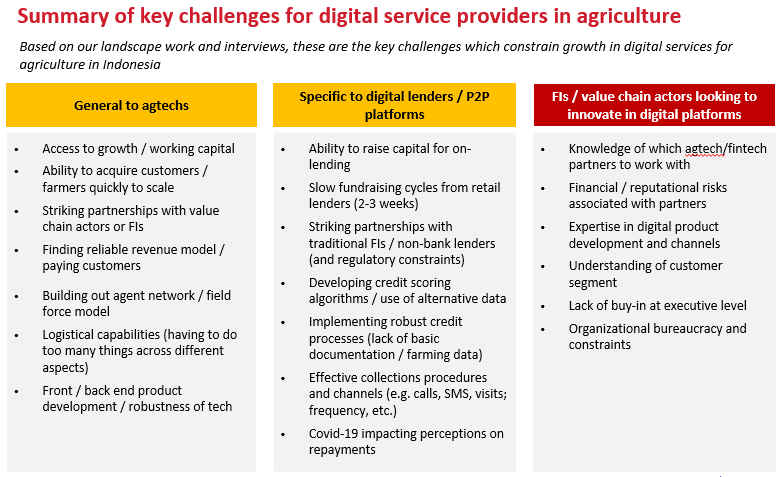

Source: Report Authors (2020)

Potential Interventions

Farmers may have diverse financial, information, and commercial needs but credit/savings, agronomy, and market linkages are the most urgent. Farmers can benefit from digital solutions in supply chain and data management, market access, digital financial services, digital information, and precision agriculture. We outline a series of twelve potential interventions of interest to development actors and funders.

To read the study in detail, please access the following resources:

If you want to find out more, please get in touch with us.